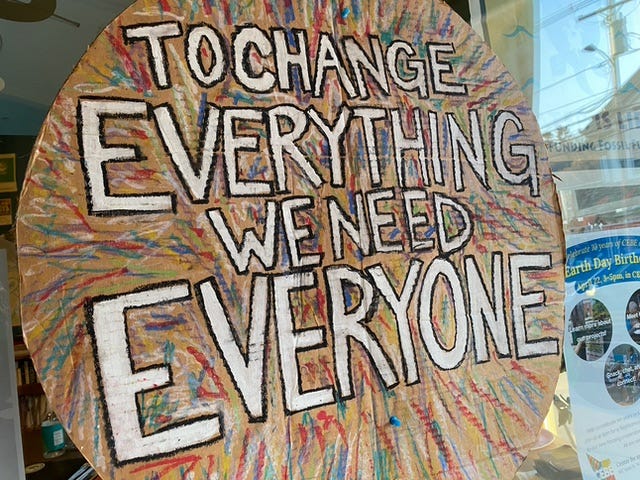

As we noted in our last blog, Third Act Mainers marked Earth Day vibrantly, and humorously, as today’s newsletter title shows. The Portland Press had a great writeup of the intergenerational event, which you can read here. And the Belfast action was covered in the Republican Journal.

Last week Maine Calling aired an interview with activist George Lakey, which is worth a listen here. Lakey has been successful in stopping PNC Bank and its environmental devastation in his state. We especially liked Lakey’s encouragement to think not only of individual actions, but also the longer, sustained campaigns that incite long-term societal change.

Here at Third Act Maine we are organizing campaigns for the months ahead. In this newsletter we’ll give a taste of a couple of initiatives we will focus on: (1) Pine Tree Power ballot initiative to create a consumer-owned utility, and (2) pressuring banks and the holders of public retirement accounts to divest from new fossil fuel projects.

The purpose of this newsletter is to give you some information on these two issues by following the links. (Anything underlined is a link: If you click on it, you’ll be taken to a website with more information.)

Pine Tree Power—Maine’s November Ballot Initiative for a Consumer-Owned Electrical Utility

Perhaps you have received a slick mailer that paints a dire image about the future of the Maine power grid, or you’ve seen TV ads with the same message? These are funded by Maine’s biggest power company—CMP (whose parent company is Avangrid) which is aiming to frighten us about the upcoming ballot initiative that would reorganize ownership of Maine’s power grid. (Read one citizen’s response to the mailers here, or another’s here.)

Recent court rulings—a clarification of the ballot wording, read about that here—have helped publicize the ballot question. The central issue is: Who should control Maine’s electrical grid? Should it be corporations? (Who are good at spending it on pricey mailings and at sending profits out of state to shareholders.) Or consumers? (Who can reinvest earnings to improve the grid. The name of the proposed organization is Pine Tree Power Company.)

There is a lot to learn, and a lot of ways you can help. Start by getting familiar with Our Power. (Our Power is a group working to pass the Pine Tree Power proposal.) In other states folks like you and I have benefitted from a switch to consumer-owned power. Indeed, about 1 in 3 Americans get their electricity from publicly owned utilities or from cooperatives.

To combat climate change we have to electrify everything. We’ll want our power grid managed by entities that have Mainers’ well-being in mind, not the well-being of an out-of-state corporation.

We can do this—with your help. Stay tuned for specific actions we’ll be advocating.

Maine’s Public Employees Retirement System (MPERS)

Not all of us are public employees, with funds invested in the state’s $17 billion dollar pension system (known hereafter as MPERS—Maine Public Employees Retirement System, a non-profit). Yet every one of us plays a societal role in how money is used.

Banks and investment firms lend our funds to others—or invest them—to keep making money. (As you may remember from our 3.21.23 action, Third Act’s mission is to get each of us to stop lending our funds to the fossil-fuel industry. Read up on that here if you’ve missed it in past newsletters.)

MPERS is having a hard time divesting itself from fossil fuels, despite the 2021 law, LD 99, An Act To Require the State To Divest Itself of Assets Invested in the Fossil Fuel Industry. According to its 2022 ESG (Environmental, Social, and Governance) Report, MPERS sees divesting from fossil fuels as contrary to its fiduciary role in making money. So they won’t.

Sound familiar? It’s a common refrain. The fossil-fuel companies have made record profits since Russia’s invasion of Ukraine. Pull your funds out of fossil fuels now and you lose out on record earnings. BUT. . . What about all the ways we lose out by continuing to burn fossil fuels? Repeated river flooding, sea level rising, destructive hurricanes, the warming Gulf of Maine? Who can be courageous enough to say “Enough is enough— I’ll sacrifice some income. Move my funds out of fossil fuels,” so that the oil companies can no longer fuel climate change?

If you divested from fossil fuels, and I divested, and everyone we knew divested, we would change the world.

Stay tuned for actions we can take about MPERS and our individual money pipelines. We’ll do a brief overview of how powerful monied interests are trying to prohibit principled ESG investing in state pensions around the country. In fact, one Maine lawmaker is trying to introduce such legislation in Augusta this year. Read about that effort here, and learn more about ESG investing here.

Maine Spirit—For Cod’s Sake

We love the Maine spirit evident on Earth Day—and each day going forward as we grapple with our warming planet and rising seas. Thanks for reading this far and doing your part. We can tackle this by working together.

If you want a pick-me-up, check out this Third Act playlist (which starts with an introduction of other Third Act voices, including Jane Fonda’s).

It may help you keep up your energy, humor, and courage—for cod’s sake!

I have been a loyal and satisfied customer of LL Bean, but I divested myself of their LL Bean credit card, because out was run by Chase Bank...last time I was at their store I paid with another credit card, and the cashier asked me why I no longer have my LL Bean credit card, and I told her. She genuinely seemed unaware of the conflict and said she would ask ab out it. Perhaps a start. chuck glassmire